TAA 24A-002 Medical Products

QUESTION: Whether Taxpayer’s purchases of two medical products from . (“Vendor”) are exempt from Florida sales tax.

RESPONSE: Both medical products are exempt from Florida sales tax as both products carry Prescription labels and Single Use labels.

March 18, 2024

Technical Assistance Advisement

STATUTE CITE(S): Sections 212.08 and 215.26, Florida Statutes (F.S.)

RULE CITES: Rules 12A-1.014 and 12A-1.020, Florida Administrative Code (F.A.C.)

__________________ ("Taxpayer")

FEIN: __________________

BP#: __________________

Dear __________________:

This is in response to your letter dated __________________, requesting this Department’s issuance of a Technical Assistance Advisement (“TAA”) pursuant to section 213.22, F.S., and Rule Chapter 12-11, F.A.C., concerning the matter referenced below. An examination of your letter has established that Taxpayer has complied with the statutory and regulatory requirements for issuance of a TAA. Therefore, the Department is hereby granting your request for a TAA.

Requested Advisement

Whether Taxpayer’s purchases of two medical products1 from Vendor are exempt from Florida sales tax. If the two medical products are specifically exempt from Florida sales tax, what remedy does Taxpayer have if Vendor has charged Florida sales tax on its sales to Taxpayer of such products?

Facts

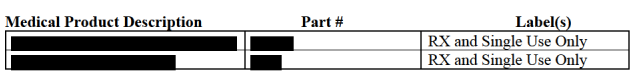

Taxpayer operates several. Taxpayer purchased the following products from Vendor, and Vendor charged Taxpayer Florida sales tax on the sales price of each of the products. Taxpayer asserts that the two products listed below are specifically exempted from Florida sales and use tax under Rule 12A-1.020(6)(c), F.A.C.

Taxpayer described the two products under advisement as follows:

_______________________________________________________________ ____________________________________

____________________________________ ____________________________________ __________________

______________________________________________________ __________________ __________________

____________________________________ __________________ ____________________________________

__________________ ______________________________________________________ __________________

______________________________________________________ __________________ __________________

Law and Discussion

Medical Products

Unless a specific exemption applies, s. 212.05, F.S., provides it is the legislative intent that eve1y person is exercising a taxable privilege that engages in the business of selling tangible personal property in this state. For exercising such a privilege, a tax is levied on each taxable transaction or incident. The tax is due and payable at the rate of 6 percent, plus any applicable surtaxes imposed under s. 212.055, F.S., on the total consideration received for each item or article of tangible personal property when sold at retail in this state. Exemptions from tax are strictly construed against the claimant. Wanda Marine Corp. v. Dep't of Revenue, 305 So. 2d 65, 69 (Fla. 1st DCA 1975).

Section 212.08(2)(a), F.S., provides that certain medical products and supplies2 are specifically exempt from tax when dispensed according to an individual prescription written by a prescriber authorized by law. Additionally, items are exempt if included on the Nontaxable Medical Items and General Grocery List, form DR-46NT, as approved by the Department of Business and Professional Regulation.

Pursuant to Rule 12A-1.020(6)(c)1., F.A.C., medical products, supplies, or devices sold to hospitals and healthcare entities or to licensed practitioners are exempt when dispensed under federal or state law only by the prescription or order of a licensed practitioner and are intended for use on a single patient and not intended to be reusable.

The two medical products referenced above, the __________________ and the __________________ are labeled RX and Single Use Only and thus both medical products would be specifically exempt from Florida sales tax. See s. 212.08(2)(a), F.S. and Rule 12A1.020(6)(c)1., F.A.C.

Refunds

Section 215.26, F.S., discusses refunds of taxes paid in error, and it states in pertinent part as follows:

(1) The Chief Financial Officer may refund to the person who paid same, or his or her heirs, personal representatives, or assigns, any moneys paid into the State Treasury which constitute:

(a) An overpayment of any tax, license, or account due;

(b) A payment where no tax, license, or account is due; and

(c) Any payment made into the State Treasury in error;

***

(2) Application for refunds as provided by this section must be filed with the Chief Financial Officer, except as otherwise provided in this subsection, within 3 years after the right to the refund has accrued or else the right is barred. Except as provided in chapter 198 and ss. 220.23 and 624.50921, an application for a refund of a tax enumerated in s. 72.011, which tax was paid after September 30, 1994, and before July 1, 1999, must be filed with the Chief Financial Officer within 5 years after the date the tax is paid, and within 3 years after the date the tax was paid for taxes paid on or after July 1, 1999....

***

(4) This section is the exclusive procedure and remedy for refund claims between individual funds and accounts in the State Treasury.

***

Rule 12A-1.014, F.A.C., implements the refund procedures with respect to sales and use tax, and it states in pertinent part as follows:

***

(3) Whenever a dealer credits a customer with tax on returned merchandise or for tax erroneously collected, the dealer must refund such tax to the customer before the dealer's claim to the State for credit or refund will be approved.

(4) A taxpayer who has overpaid tax to a dealer, or who has paid tax to a dealer when no tax is due, must secure a refund of the tax from the dealer and not from the Department of Revenue.

(5)(a) Any dealer entitled to a refund of tax paid to the Department of Revenue may seek a refund by filing an Application for Refund-Sales and Use Tax (form DR-26S, incorporated by reference in Rule 12-26.008, F.A.C.) with the Department. Form DR-26S must meet the requirements of Sections 213.255(2) and (3), F.S., and Rule 12-26.003, F.A.C.

There must be sufficient documentation and information to prove that sales taxes were paid in error on Taxpayer’s purchases of the two products under advisement from its Vendor, before a refund of such taxes is due. Once this has been established, the refund of taxes paid in error must be secured from the Vendor (dealer) to whom Taxpayer paid the taxes. After Vendor has refunded the taxes paid in error to Taxpayer, Vendor would then submit an application for refund (Form DR-26S, Application for Refund – Sales and Use Tax Only) to the Department for a refund of the taxes paid in error.

If Vendor does not wish to refund the sales taxes paid in error to Taxpayer, s. 215.26, F.S., authorizes the Department to refund the taxes to Taxpayer as an assignee. In this case, Vendor is assigning its right to the refund to Taxpayer, and Taxpayer would apply directly to the Department of Revenue for the refund of the sales taxes paid in error. The Department does not have a standard assignment form that is required to be filed. A Form DR-26A, Assignment of Rights to Refund of Tax, may be used for the assignment of rights. Form DR-26A must be filled out by Vendor and notarized, and returned to Taxpayer. Taxpayer should include Form DR-26A, along with Form DR-26S and all documentation showing that it paid the taxes to Vendor in error, if Taxpayer applies for a refund. All documents should be sent to the address on the DR-26S. The statute of limitations on claiming refunds is three years from the date the tax was remitted.

Conclusion

As provided in Rule 12A-1.020(6)(a), F.A.C., a medical product’s label provides the medical product’s purpose. Vendor’s sales of the two medical products under advisement are exempt from Florida sales tax under Rule 12A-1.020(6)(c)1., F.A.C. since both products carry “RX” and “Single Use” labels. If Taxpayer thinks that Florida sales tax was paid in error to Vendor, please follow the advice provided in this TAA under the heading, “Refunds.”

This response constitutes a TAA under s. 213.22, F.S., which is binding on the Department only under the facts and circumstances described in the request for this advice, as specified in s. 213.22, F.S. Our response is predicated on those facts and the specific situation summarized above. You are advised that subsequent statutory or administrative rule changes, or judicial interpretations of the statutes or rules, upon which this advice is based, may subject similar future transactions to a different treatment than expressed in this response.

You are further advised that this response, your request and related backup documents are public records under Chapter 119, F.S., and are subject to disclosure to the public under the conditions of s. 213.22, F.S. Confidential information must be deleted before public disclosure. In an effort to protect confidentiality, we request you provide the undersigned with an edited copy of your request for TAA, the backup material and this response, deleting names, addresses and any other details which might lead to identification of the Taxpayer. Your response should be received by the Department within ten (10) days of the date of this letter.

Leigh L. Ceci, MAcc

Tax Law Specialist

Technical Assistance & Dispute Resolution

(1) In an email, dated _________, Taxpayer withdrew its request for a TAA for 6 of the 8 products initially listed in its original TAA request, dated _________, as Taxpayer could not find enough support to request a binding TAA on the 6 products removed from the TAA request.

(2) “Medical products, supplies, or devices” are “any products, supplies, or devices that are intended or designed to be used for a medical purpose to treat, prevent, or diagnose human disease, illness, or injury. The purpose is assigned to a product, supply, or device by its label or its general instructions for use.” See Rule 12A-1.020(6)(a), F.A.C.