TAA 23C1-010 Determination of Income

QUESTION: Taxpayer requests a written agreement to determine how the qualifying project’s income will be computed, based upon s. 220.191, F.S., and Rule 12C1.0191, F.A.C.

ANSWER: Based on the representation of Taxpayer, the Department concurs with Taxpayer’s suggested calculation for the income generated by or arising out of the qualifying project based upon s. 220.191, F.S., and Rule 12C-1.0191, F.A.C. However, Taxpayer is reminded that should the facts provided in its request of September 2, 2022, be determined to be incorrect or changed, the computation for the income generated by or arising out of the project could be substantially different from what has been agreed upon in this TAA.

July 14, 2023

Technical Assistance Advisement – 23C1-010

Request for Written Agreement for Determination of Income

Sections 220.11, 220.13, 220.15, 220.191, Florida Statutes (“F.S.”)

Rule 12C-1.0191, Florida Administrative Code (“F.A.C.”)

__________________ (“Taxpayer”)

FEIN: __________________

Project ID: __________________

__________________ Florida Department of Economic Opportunity1 (“DEO”)

Enterprise Florida, Inc. (“EFI”)

Dear __________________:

This is in response to your request dated September 2, 2022, for a Technical Assistance Advisement (“TAA”) pursuant to section 213.22, F.S., and Rule Chapter 12-11, F.A.C., regarding your request for an agreement concerning how the method by which income generated by or arising out of Taxpayer’s qualified capital investment project shall be determined for purposes of applying the Capital Investment Tax Credit (“CITC”).

Section 220.191(5), F.S., addresses applications for CITC. That statute provides:

Applications shall be reviewed and certified pursuant to s. 288.061. The Department of Economic Opportunity, upon recommendation by Enterprise Florida, Inc., shall first certify a business as eligible to receive tax credits pursuant to this section prior to the commencement of operations of a qualifying project, and such certification shall be transmitted to the Department of Revenue. Upon receipt of the certification, the Department of Revenue shall enter into a written agreement with the qualifying business specifying, at a minimum, the method by which income generated by or arising out of the qualifying project will be determined.

Pursuant to Rule 12C-1.0191, F.A.C., the Department of Revenue has adopted TAAs as the method for entering into such written agreements.

On __________________, DEO certified Taxpayer as eligible to receive tax credits under s. 220.191, F.S. The Department of Revenue, having received said certification, has examined your letter and has established that you have complied with the statutory and regulatory requirements for issuance of a TAA. Therefore, the Department of Revenue is hereby granting your request for a TAA. The Department of Revenue, in issuing this TAA, has relied on the representations of Taxpayer and the certification of the Department of Economic Opportunity. This TAA specifies the method by which income generated by or arising out of the qualifying project will be determined based on the facts as represented to the Department of Revenue. This response to your request constitutes a Technical Assistance Advisement under Chapter 12-11, F.A.C., and is issued to you under authority of s. 213.22, F.S.

ISSUE PRESENTED

In its letter dated September 2, 2022, Taxpayer requests a written agreement to determine how the qualifying project’s income will be computed, based upon s. 220.191, F.S., and Rule 12C-1.0191, F.A.C.

FACTS SUPPLIED BY TAXPAYER

Taxpayer is an __________________ that __________________, __________________,and __________________ on . Through its affiliates, Taxpayer also owns, operates and/or licenses as __________________, approximately __________________, as well as owns and operates several __________________. Taxpayer recently expanded its ____________________________________ __________________. It also acquired a ____________________________________ which produces and distributes content __________________.

Taxpayer and its subsidiaries are headquartered in __________________, with additional subsidiaries (“Division”) located throughout the __________________. Each Division maintains __________________. Florida corporate income tax returns are filed by Taxpayer as two separate filing groups.

Taxpayer is a __________________. Taxpayer is generally exempt from U.S. income tax under Internal Revenue Code (“IRC”) Section 501(c)(6). It is treated as a single entity filer for both federal and Florida purposes. Taxpayer’s income is generally nontaxable under IRC Section 501; however, Taxpayer also has income that is taxable under IRC Section 511 as unrelated business income. Taxpayer files a federal informational Form 990 along with Form 990-T, Exempt Organization Business Income Tax Return. Taxpayer files a Form F-1120 to report and pay tax on any unrelated business income that is apportioned to Florida per s. 220.131(5), F.S.

__________________ (“Holdings”) is a __________________ company incorporated in Florida, and a subsidiary of Taxpayer. Holdings is the parent to several separate __________________. Holdings is a separate taxpayer from its __________________ and files a separate federal consolidated Form 1120. Holdings has elected to file a consolidated Florida corporate income tax return.

Taxpayer’s first project (“Project 1”), the __________________, was certified by DEO on __________________. Taxpayer and the Department entered into a written agreement, TAA 17C1-010, on November 3, 2017. Taxpayer stated Project 1 commenced operations in __________________.2

The subject of this TAA is its second project (“Project 2”), a __________________. Project 2 was certified by DEO on __________________. Project 2 consists of the expansion of Taxpayer’s __________________ with the construction of a new __________________. The project will also include improvements to parking, landscaping, and greenspace. The project will allow Taxpayer to bring all __________________. It will also allow for future growth and provide Taxpayer with a __________________.

Taxpayer intends to make a capital investment of over $ __________________ and will create at least __________________ paying an estimated average __________________, in connection with the project. Taxpayer anticipates Project 2 will commence operations in __________________.

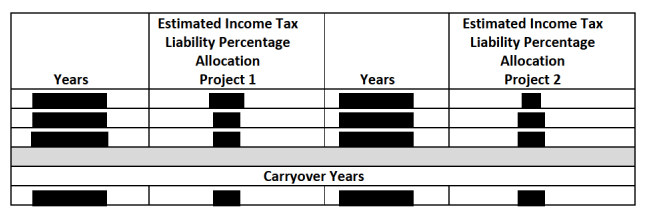

Taxpayer proposes using the same method to determine project income as Project 1, which provides that all of its income is considered income generated by or arising out of the qualifying project. Since all income would be considered project income for both Project 1 and Project 2, Taxpayer proposes allocating the tax liability of Taxpayer between the two projects based on the following schedule.3

LEGAL AUTHORITY

Section 220.11, F.S., states in part:

(1) A tax measured by net income is hereby imposed on every taxpayer for each taxable year commencing on or after January 1, 1972, and for each taxable year which begins before and ends after January 1, 1972, for the privilege of conducting business, earning or receiving income in this state, or being a resident or citizen of this state. Such tax shall be in addition to all other occupation, excise, privilege, and property taxes imposed by this state or by any political subdivision thereof, including any municipality or other district, jurisdiction, or authority of this state....

Section 220.13, F.S., states in part:

(1) The term "adjusted federal income" means an amount equal to the taxpayer's taxable income as defined in subsection (2), or such taxable income of more than one taxpayer as provided ins. 220.131, for the taxable year, adjusted as follows: ...

Section 220.15, F.S., states in part:

(1) Except as provided in ss. 220.151, 220.152, and 220.153, adjusted federal income as defined ins. 220.13 shall be apportioned to this state by taxpayers doing business within and without this state by multiplying it by an apportionment fraction composed of a sales factor representing 50 percent of the fraction, a property factor representing 25 percent of the fraction, and a payroll factor representing 25 percent of the fraction....

Section 220.191, F.S., states in part:

(1) DEFINITIONS.-For purposes of this section:

(a) “Commencement of operations” means the beginning of active operations by a qualifying business of the principal function for which a qualifying project was constructed.

(b) “Cumulative capital investment” means the total capital investment in land, buildings, and equipment made in connection with a qualifying project during the period from the beginning of construction of the project to the commencement of operations.

(c) “Eligible capital costs” means all expenses incurred by a qualifying business in connection with the acquisition, construction, installation, and equipping of a qualifying project during the period from the beginning of construction of the project to the commencement of operations, including, but not limited to: …

(d) “Income generated by or arising out of the qualifying project” means the qualifying project’s annual taxable income as determined by generally accepted accounting principles and under s. 220.13.

***

(f) “Qualifying business” means a business which establishes a qualifying project in this state and which is certified by the Department of Economic Opportunity to receive tax credits pursuant to this section.

***

(2)(a) An annual credit against the tax imposed by this chapter shall be granted to any qualifying business in an amount equal to 5 percent of the eligible capital costs generated by a qualifying project, for a period not to exceed 20 years beginning with the commencement of operations of the project. …The annual tax credit granted under this section shall not exceed the following percentages of the annual corporate income tax liability or the premium tax liability generated by or arising out of a qualifying project:

- One hundred percent for a qualifying project which results in a cumulative capital investment of at least $100 million.

- Seventy-five percent for a qualifying project which results in a cumulative capital investment of at least $50 million but less than $100 million.

- Fifty percent for a qualifying project which results in a cumulative capital investment of at least $25 million but less than $50 million.

***

(d) If the credit granted under subparagraph (a)1. is not fully used in any one year because of insufficient tax liability on the part of the qualifying business, the unused amounts may be used in any one year or years beginning with the 21st year after the commencement of operations of the project and ending the 30th year after the commencement of operations of the project.

***

(4) Prior to receiving tax credits pursuant to this section, a qualifying business must achieve and maintain the minimum employment goals beginning with the commencement of operations at a qualifying project and continuing each year thereafter during which tax credits are available pursuant to this section.

(8) The Department of Revenue may specify by rule the methods by which a project’s pro forma annual taxable income is determined.

DISCUSSION

On __________________, DEO issued a letter approving Taxpayer’s project for participation in Florida’s CITC program, and indicated in its letter that the qualifying project will be located in a High Impact Performance Incentive Sector pursuant to s. 288.108, F.S. The certification approval entitles the project to eligibility for an annual tax credit against the corporate income tax imposed if certain criteria are met, in an amount equal to the lesser of the following for up to twenty years, beginning with the commencement of operations:

- Five (5) percent of the cumulative capital investment, which is estimated to be over $100 million, but must be at least $25 million;

- Fifty (50%), seventy-five (75%), or one hundred percent (100%) of the annual corporate income tax liability generated by or arising out of the qualifying project, depending on the level of cumulative capital investment; or

- The tax due on the Florida corporate income tax return of Taxpayer prior to the application of this credit that includes the income generated by or arising out of the qualifying project.

DEO has required that the qualifying project meet certain criteria by the commencement of operations. The “commencement of operations” (as defined in s. 220.191, F.S.) will not be deemed to occur unless Taxpayer has provided DEO with evidence that it has met the following criteria:

1. Capital investment of at least $ __________________ has been made at the project’s location in __________________; and

2. Creation of at least __________________ paying at least the project wage at the project’s location in __________________.

No annual CITC may be claimed without a letter from DEO stating that the appropriate annual requirements have been satisfied or maintained.

According to DEO’s certification letter, Taxpayer is expected to make a cumulative capital investment of over $ __________________ in connection with the qualifying project. If Taxpayer makes at least a $__________________ cumulative capital investment prior to commencement of operations, it will be eligible to receive CITCs equal to up to 100% of its annual corporate tax liability generated by or arising out of the qualifying project.

Taxpayer has proposed that the Florida portion of adjusted federal taxable income reported on its Florida corporate income tax return is income generated by or arising out of the qualifying projects, Projects 1 and 2. The taxable income would then be multiplied by the applicable tax rate. The tax liability would then be allocated to each qualifying project using the schedule stated above. The allowable CITC will be limited to the lesser of the limitations stated above.

Department agrees with Taxpayer’s proposed method. The Florida income of Taxpayer rests with the __________________ and the __________________ there. With the second project expanding and creating the __________________, most of Taxpayer’s taxable income will now arise out of Project 2 instead of Project 1. As a result, these percentages are reasonable4 . The Department acknowledges that the years in which the credit may be used are subject to change based on DEO’s determination of commencement of operations.

Taxpayer must apply generally accepted accounting principles and the provisions of s. 220.13, F.S., in computing the income of the qualifying project. Taxpayer will be required to provide with its Florida corporate income tax return a schedule of the allocation of tax liability and corresponding credit to each project.

Pursuant to s. 220.191(2)(d), F.S., when the capital investment is at least $ __________________, credit amounts not fully used in any one year because of insufficient tax liability on the part of the qualifying business may be used in any one year or years beginning with the 21st year after the commencement of operations of the project and ending with the 30th year after the commencement of operations of the qualifying project.

The amount of carryover from any one taxable year is five (5) percent of the cumulative capital investment that is at least $ __________________ less the amount of capital investment tax credit that could be used on the tax return for the taxable year. The amount of carryover from a taxable year may not exceed five (5) percent of the cumulative capital investment that is at least $ __________________ . The carryover for both projects will be allocated based on the schedule stated above.

CONCULSION

Given the specific circumstances involved in this case, and based on the representation of Taxpayer, the Department concurs with Taxpayer’s suggested calculation for the income generated by or arising out of the qualifying project based upon s. 220.191, F.S., and Rule 12C1.0191, F.A.C. However, Taxpayer is reminded that should the facts provided in its request of September 2, 2022, be determined to be incorrect or changed, the computation for the income generated by or arising out of the project could be substantially different from what has been agreed upon in this TAA.

This response constitutes a Technical Assistance Advisement under section 213.22, F.S., which is binding on the Department only under the facts and circumstances described in the request for this advice as specified in section 213.22, F.S. Our response is based on those facts and specific situation summarized above. You are advised that subsequent statutory or administrative rule changes or judicial interpretations of the statutes or rules upon this advice is based may subject future transactions to a different treatment than expressed in this response.

You are further advised that this response, your request and related backup documents are public records under Chapter 119, F.S., and are subject to disclosure to the public under the conditions of section 213.22, F.S. Confidential information must be deleted before public disclosure. In an effort to protect confidentiality, we request you provide the undersigned with an edited copy of your request for Technical Assistance Advisement, the backup material and this response, deleting names, addresses and any other details which might lead to identification of the taxpayer. Your response should be received by the Department within 15 days of the date of this letter.

Susan Coxwell

Revenue Program Administrator

Technical Assistance and Dispute Resolution

(1) Chapter 2023-173, Laws of Florida renamed the Florida Department of Economic Opportunity to the Florida Department of Commerce.

(2) _______________________________________________________________

(3) _______________________________________________________________

(4) In addition, we note these percentages have little to no impact on the overall benefit of this credit to Taxpayer.