TAA 22A-020 Net Metering

Scenario I

QUESTION 1: Should GRT be calculated on the customer’s net positive consumption before the credit from the PV Bank balance is applied, or after?

RESPONSE: Gross receipt tax should be calculated based on the amount of money received from Taxpayer’s customers for charges for utility services. This would be the net amount of electricity billed to the customer after allowing a credit for the excess electricity generated by the customer and returned to the utility.

Scenario II

QUESTION 1: Should the GRT tax be calculated on each of the three TOU periods independently or should the three periods be netted together to get total Net Consumption (“Total Net Consumption”)? For example, the two periods (Peak and Shoulder) with a negative Net Consumption would have no tax, but the Off-Peak period with positive consumption would be subject to the tax.

RESPONSE: Gross receipts tax should be calculated on the three TOU periods together to get total net consumption.

QUESTION 2: If the Total Net Consumption should be used for the GRT calculations, would the credits resulting from negative Total Net Consumption offset the fixed Customer and Demand Charges, when calculating GRT?

RESPONSE: Gross receipt tax should be calculated based on the amount of money received from Taxpayer’s customers for charges for utility services; therefore, the credits resulting from negative total net consumption would offset the fixed customer and demand charges.

Scenario III

QUESTION 1: Should the GRT be calculated on each of the three components and if so, is it permissible to itemize the GRT for each of the three components on an individual customer’s bill?

RESPONSE: The fixed customer charge, the block charge, and additional consumption of above their solar allotment are subject to Florida gross receipts tax for utility services. The gross receipts tax is imposed on the total amount of gross receipts received by the utility provider for electrical power or energy; therefore, the three components total in one utility bill is subject to the gross receipts tax. It would be permissible to itemize the GRT for each of the three components on an individual customer’s bill.

Scenario IV

QUESTION 1: Would the credit be netted against the customer charge (or the solar block charges in the previous scenario) when calculating the GRT?

RESPONSE: Gross receipt tax should be calculated based on the amount of money received from Taxpayer’s customers for charges for utility services; therefore, the credit would be netted against the customer charge or the solar block charge when calculating the gross receipts tax.

October 4, 2022

Technical Assistance Advisement – TAA #: 22A-020

XXXX (“Taxpayer”)

Gross Receipts Tax – Net Metering

Sections 203.01, 203.012, Florida Statutes (“F.S.”)

BP #: XXXX

Dear Mr. XXXX,

This is in response to your letter dated July 25, 2022, requesting this Department’s issuance of a TAA pursuant to Section 213.22, F.S., and Chapter 12-11, Florida Administrative Code, regarding Gross Receipts Tax. Your request has been carefully examined, and the Department finds it to be in compliance with the requisite criteria set forth in Chapter 12-11, F.A.C. This response to your request constitutes a TAA and is issued to you under the authority of s. 213.22, F.S.

Stated Facts

Taxpayer is a municipal utility that provides electric and water services to more than 300,000 customers within the City of Orlando, the City of St. Cloud, and unincorporated parts of Orange and Osceola counties in Florida.

Taxpayer owns and operates seven electric generating units consisting of coal and natural gasfired power plants. Taxpayer also owns a minority interest in nuclear power plants owned and operated by XXXX. In addition, Taxpayer continues to grow its renewable energy portfolio through community solar farms and solar-related power purchase agreements. From the combination of the aforesaid sources, Taxpayer has an electric generation capacity of approximately 1,900 mW for retail and wholesale sales.

In November 2017, Taxpayer launched residential and commercial customer-sited renewable energy initiatives through its net metering, solar thermal, and solar aggregation programs. Net metering is a method of metering the energy consumed and produced at a home or business that has its own renewable energy generator (ostensibly photovoltaic (“PV”) solar panels). Under net metering, excess electricity produced at a home or business is used to offset the electricity received from Taxpayer. To date, Taxpayer has over 2600 customers participating in its net metering program with over 27,000 kW of generation capacity installed through customer-sited residential and commercial photovoltaic systems.

For customers interested in renewable energy, but unable to have their own PV solar panels, Taxpayer offers those customers the option to purchase solar blocks, which entitle them to a set amount of Taxpayer produced solar energy each month. The price of the solar blocks are billed each month (as if the customer “owned” the solar production), regardless of the amount of energy they consume. Customers are also billed a fixed customer charge and for any additional consumption above their solar block allotment. If the customer consumes less than their solar block allotment, they receive a credit that is applied to their balance due.

Requested Advisements

Taxpayer is requesting guidance on the application of the Gross Receipts Tax in the following scenarios with respect to net metering:

Solar PV Net Metering

Excess customer energy produced by its customers is sold back to Taxpayer, and Taxpayer offsets consumption by the customer, resulting in net consumption (“Net Consumption”). The customer is billed for their Net Consumption, as well as, a fixed customer charge (“Customer Charge”). The Gross Receipts Tax (GRT) is calculated on the Customer Charge and Net Consumption. When the customer’s energy production exceeds their consumption (essentially negative Net Consumption), they receive a credit on their monthly bill which is added to their “PV Bank” and applied to their balance due in future months. Customers are then billed only for the Customer Charge, and the GRT is calculated only on this charge.

Scenario I

During previous months, the customer produced and sold to Taxpayer more energy than they consumed, resulting in a credit balance in the “PV Bank.” For the current month, the customer consumed more energy from Taxpayer than they produced and sold, and their PV Bank balance was applied to offset the billed amount.

Question 1.

Should GRT be calculated on the customer’s net positive consumption before the credit from the PV Bank balance is applied, or after?

Solar PV Net Metering – Commercial Time of Use (TOU) rate

Taxpayer recently implemented a Time of Use (TOU) or Time of Day (TOD) rate where customers are billed different rates, depending on their consumption at different periods during the day. The TOU or TOD rate will also be applied to the generation supplied by customer-owned renewable generation sold back to Taxpayer. There are three different TOU periods: Peak, Shoulder, and Off Peak. Excess customer production is sold back to Taxpayer, and offsets any consumption by the customer, resulting in net consumption (“Net Consumption”). Net Consumption is computed for each of the three TOU periods. The customer is billed for their Net Consumption for all three periods, as well as, a fixed Customer Charge and Demand Charge. The GRT is calculated on the Customer and Demand Charges, and their Net Consumption. When the customer has excess production (essentially negative Net Consumption) for any of the three TOU periods, they receive a credit, which is applied to their balance due in future months.

Scenario II

During the current month, the customer has negative Net Consumption during both Peak and Shoulder periods, resulting in a credit. However, they have positive Net Consumption during the Off-Peak period resulting in a billed amount for that period, as well as billed amounts for the fixed Customer and Demand charges.

Question(s)

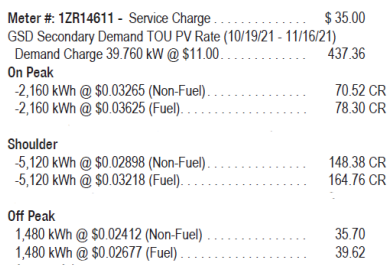

1. Should the GRT tax be calculated on each of the three TOU periods independently or should the three periods be netted together to get total Net Consumption (“Total Net Consumption”)? For example, the two periods (Peak and Shoulder) with a negative Net Consumption would have no tax, but the Off-Peak period with positive consumption would be subject to the tax (See example below).

2. If the Total Net Consumption should be used for the GRT calculations, would the credits resulting from negative Total Net Consumption offset the fixed Customer and Demand Charges, when calculating GRT?

In the example below, Total Net Consumption would be negative 5,800 kWh and a credit of $386.64. With a fixed customer Service Charge of $35.00 and Demand Charge of $437.36, the total billed amount before tax considerations is $85.72 ($35.00 Service Charge plus Demand Charge $437.36 minus $386.64 Credit).

Solar Block Purchases

Taxpayer calculates and remits GRT based on its financial statement revenue from solar block purchases and not from billed revenue; so, the GRT with respect to the solar block purchases does not flow through to an individual customer’s bill. Only the GRT with respect to the Customer Charge and consumption above the customer’s respective solar block allotment is itemized on a customer’s individual bill. Taxpayer proposes to separately itemize the gross receipts tax on the individual customer’s bill for solar block purchases, in addition to the fixed Customer Charge and consumption above the customer’s solar block allotment.

Scenario III

In the current month, a customer has a fixed customer charge, purchases XX solar blocks, and uses an additional 100 kWh above their solar allotment.

Question

- Should the GRT be calculated on each of the three components and if so, is it permissible to itemize the GRT for each of the three components on an individual customer’s bill?

Scenario IV

In the current month, a customer has a fixed customer charge, purchases XX solar blocks, and uses 100 kWh less than their solar allotment, resulting in a credit that reduces their amount due.

Question

1. Would the credit be netted against the customer charge (or the solar block charges in the previous scenario) when calculating the GRT?

Law and Discussion

Gross Receipts Tax

Section 203.01, F.S., imposes the gross receipts tax on the total amount of gross receipts received by a distribution company1 for utility services2 . The rate applied to utility services is 2.5 percent. Taxpayer is a distribution company; it would be required to pay gross receipts tax on its total receipts from charges for utility service sold to a retail consumer. If the customer pays $100 on the net electricity that the consumer purchased, the distribution company is taxed on the $100 received.

Taxpayer should remit the gross receipts tax based on the actual amount received from its customers for utility services. This would be the net amount of electricity billed to the customer after allowing a credit for the excess electricity generated by the customer and returned to the utility.

Conclusion

Solar PV Net Metering

Scenario I

During previous months, the customer produced and sold to Taxpayer more energy than they consumed, resulting in a credit balance in the “PV Bank.” For the current month, the customer consumed more energy from Taxpayer than they produced and sold, and their PV Bank balance was applied to offset the billed amount.

Question 1: Should GRT be calculated on the customer’s net positive consumption before the credit from the PV Bank balance is applied, or after?

Response: Gross receipt tax should be calculated based on the amount of money received from Taxpayer’s customers for charges for utility services. This would be the net amount of electricity billed to the customer after allowing a credit for the excess electricity generated by the customer and returned to the utility.

Solar PV Net Metering – Commercial Time of Use (TOU) rate

Scenario II

During the current month, the customer has negative Net Consumption during both Peak and Shoulder periods, resulting in a credit. However, they have positive Net Consumption during the Off-Peak period resulting in a billed amount for that period, as well as billed amounts for the fixed Customer and Demand charges.

Question 1: Should the GRT tax be calculated on each of the three TOU periods independently or should the three periods be netted together to get total Net Consumption (“Total Net Consumption”)? For example, the two periods (Peak and Shoulder) with a negative Net Consumption would have no tax, but the Off-Peak period with positive consumption would be subject to the tax.

Response: Gross receipts tax should be calculated on the three TOU periods together to get total net consumption.

Question 2: If the Total Net Consumption should be used for the GRT calculations, would the credits resulting from negative Total Net Consumption offset the fixed Customer and Demand Charges, when calculating GRT?

Response: Gross receipt tax should be calculated based on the amount of money received from Taxpayer’s customers for charges for utility services; therefore, the credits resulting from negative total net consumption would offset the fixed customer and demand charges.

Solar Block Purchases

Scenario III

In the current month, a customer has a fixed customer charge, purchases XX solar blocks, and uses an additional 100 kWh above their solar allotment.

Question 1: Should the GRT be calculated on each of the three components and if so, is it permissible to itemize the GRT for each of the three components on an individual customer’s bill?

Response: The fixed customer charge, the block charge, and additional consumption of above their solar allotment are subject to Florida gross receipts tax for utility services. The gross receipts tax is imposed on the total amount of gross receipts received by the utility provider for electrical power or energy; therefore, the three components total in one utility bill is subject to the gross receipts tax. It would be permissible to itemize the GRT for each of the three components on an individual customer’s bill.

Scenario IV

In the current month, a customer has a fixed customer charge, purchases XX solar blocks, and uses 100 kWh less than their solar allotment, resulting in a credit that reduces their amount due.

Question 1: Would the credit be netted against the customer charge (or the solar block charges in the previous scenario) when calculating the GRT?

Response: Gross receipt tax should be calculated based on the amount of money received from Taxpayer’s customers for charges for utility services; therefore, the credit would be netted against the customer charge or the solar block charge when calculating the gross receipts tax.

This response constitutes a Technical Assistance Advisement under Section 213.22, F.S., which is binding on the Department only under the facts and circumstances described in the request for this advice, as specified in Section 213.22, F.S. Our response is predicated on those facts and the specific situation summarized above. You are advised that subsequent statutory or administrative rule changes, or judicial interpretations of the statutes or rules, upon which this advice is based, may subject similar future transactions to a different treatment than expressed in this response.

You are further advised that this response, your request and related backup documents are public records under Chapter 119, F.S., and are subject to disclosure to the public under the conditions of Section 213.22, F.S. Confidential information must be deleted before public disclosure. In an effort to protect confidentiality, we request you provide the undersigned with an edited copy of your request for Technical Assistance Advisement, the backup material and this response, deleting names, addresses and any other details which might lead to identification of the Taxpayer. Your response should be received by the Department within ten (10) days of the date of this letter.

Xiaoxi Miao

Tax Law Specialist

Technical Assistance & Dispute Resolution

(1) “Distribution company” means any person owning or operating local electric or natural or manufactured gas utility distribution facilities within this state for the transmission, delivery, and sale of electricity or natural or manufactured gas. The term does not include natural gas transmission companies that are subject to the jurisdiction of the Federal Energy Regulatory Commission. See s. 203.012(1), F.S.

(2) “Utility service” means electricity for light, heat, or power; and natural or manufactured gas for light, heat, or power, including transportation, delivery, transmission, and distribution of the electricity or natural or manufactured gas. This subsection does not broaden the definition of utility service to include separately stated charges for tangible personal property or services which are not charges for the electricity or natural or manufactured gas or the transportation, delivery, transmission, or distribution of electricity or natural or manufactured gas. See s. 203.012(3), F.S.