TAA 22A-019 Electrical Vehicle Charging Stations

QUESTION #1: Whether the Monthly Program Charge paid by a Customer participating in

Taxpayer’s Residential Program is the payment for an improvement to real property and

therefore not subject to either Sales and Use Tax or Gross Receipts Tax?

ANSWER #1: Based on the facts provided, Taxpayer is making improvements to real property;

therefore, Taxpayer would not charge its Residential customers sales tax or gross receipts tax on

the Monthly Program Charges.

QUESTION #2: Whether the Monthly Off-Peak Energy Charge paid by a Customer participating in

Taxpayer’s Residential Program is exempt from Sales and Use Tax and is subject to Gross Receipts

Tax?

ANSWER #2: Correct. The Monthly Off-Peak Energy Charges paid by residential customers are

exempt from Sales and Use Tax and are subject to Gross Receipts Tax.

QUESTION #3: Whether Monthly Service Payments paid by Customers participating in Taxpayer’s

Commercial Program are payments for the improvements to real property and therefore are not

subject to either Sales and Use Tax or Gross Receipts Tax?

ANSWER #3: Based on the facts provided, Taxpayer is making improvements to real property;

therefore, Taxpayer would not charge its Commercial customers sales tax or gross receipts tax

on the Monthly Service Payments.

QUESTION #4: Whether Taxpayer’s separate sales of electricity to Customers participating in the

Commercial Program are subject to Sales and Use Tax and subject to Gross Receipts Tax?

ANSWER #4: Correct. Taxpayer’s sales of electricity to its Commercial customers are subject to

Sales and Use Tax and are also subject to Gross Receipts Tax.

September 15, 2022

Technical Assistance Advisement 22A-019

XXX (herein “Taxpayer”)

XXX

XXX

Sales and Use Tax

Taxability of the Installation and Monthly Charges for Electric Vehicle Charging Stations

Sections: 212.02, 212.05, 212.06, 212.08, 203.01, and 366.02, Florida Statutes (F.S.)

Rules: 12A-1.051 and 12A-1.053, Florida Administrative Code (F.A.C.)

Dear Mr. XXX:

This letter is in response to your request dated September 27, 2021, and the supplemental request dated March 23, 2022, for issuance of a Technical Assistance Advisement (“TAA”) pursuant to Section 213.22, F.S., and Rule Chapter 12-11, F.A.C., concerning the taxability of the installation and monthly charges for electric vehicle charging stations. An examination of your request has established you complied with the statutory and regulatory requirements for issuance of a TAA. Therefore, the Department is hereby granting your request for a TAA.

STATEMENT OF FACTS

Taxpayer is an XXX utility in Florida. Taxpayer anticipates offering an optional Residential Electric Vehicle Charging Services Rider Pilot Program (“Residential Program”) to its customers who own electric vehicles (“EV”) and desire for charging stations to be installed at their residences. Residential Program will be limited to customers that own and reside in a single-family home or townhome with an attached garage. The residential customer must also be served under Taxpayer’s RS-1 rate schedule. Furthermore, Taxpayer anticipates offering a Commercial Electric Vehicle Charging Services Rider Pilot Program (“Commercial Program”). Commercial Program is designed to meet the needs of commercial customers who operate a fleet of EVs, which will vary from customer to customer.

Residential Program

Taxpayer provided the following documents pertaining to Residential Program as Attachments A and B, respectively: Residential Electric Vehicle Charging Services Rider Pilot (“Residential Rider”) and Optional Residential Electric Vehicle Charging Agreement (“Residential Agreement”). Residential Rider expires five years from the effective date of Residential Program, unless extended by approval of the Florida Public Service Commission (“FPSC”). Residential Agreement becomes effective at such time as the Residential Rider expires and will continue for ten (10) years.

Residential Rider and Residential Agreement both stipulate that charging equipment (“Equipment”) will be maintained and owned by Taxpayer and that Taxpayer will design, procure, install, own, operate, and provide maintenance to EV Equipment.

The Equipment being installed by Taxpayer is a level 2 electronic vehicle charger (240 volts) hardwired by a licensed electrician. Taxpayer offered an example of the type of charger that will be used. The example is a relatively small device that is affixed to a wall via a “quick-release wall mounting bracket.” It measures 6.8 inches across/wide, 5.8 inches in depth and is 18.5 inches in height. An attached hook holds the 25 foot long “output” cable and connector. The electrical wire connecting the Equipment to the hardwire conduit is 2.3 feet in length. It all weighs 15 pounds. It has WiFi connectivity capabilities.

Taxpayer reserves the right to remotely control charging session schedules and/or curtail the energy delivered by Equipment. Taxpayer will be allowed to establish connectivity with Equipment using Customer’s internet service provider. Taxpayer and its customers agree that Equipment is owned by Taxpayer and there is no license, rental, or lease of Equipment (See Residential Agreement, Paragraph 3.).

Customers will have the option to select “Full Installation” or “Equipment Only Installation” Services. Equipment Only Installations involve a Residential Customer who already has a dedicated and permitted 240-volt circuit in the garage location where the Equipment will be located. Taxpayer will hardwire the Equipment to the existing 240-volt circuit. Under no circumstance will Taxpayer ever install a charger into a 240 volt (NEMA 14-50) type outlet. Full Installations will include designing, permitting, and installing a new 240-volt circuit on Customer’s premises (See Residential Agreement, Paragraph 3.).

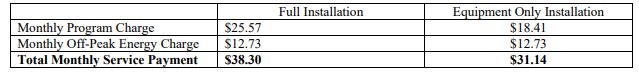

Customers will be billed a Monthly Service Payment based on whether they have a Full Installation or an Equipment Only Installation.1 The Monthly Service Payment will be comprised of a “Monthly Program Charge” and a “Monthly Off-Peak Energy Charge.” The Monthly Program Charge is for the use of the EV Equipment and is higher for Customers who choose Full Installation. The Monthly Off-Peak Energy Charge is a separate flat monthly fee for the use of Off-Peak Energy, regardless of the installation option chosen. The flat monthly fee will be the same regardless of the amount of energy used by the Equipment during Off-Peak Periods. In the event Customer charges an EV during On-Peak Periods, Customer will be charged 22.87 cents per kWh. Customer shall commence payment of the Monthly Service Payment, plus any applicable taxes, on the Residential Operation Date in accordance with the General Rules and Regulations for Electric Service. Any partial month will be paid on a pro rata basis (See Residential Rider, Monthly Service Payment and Residential Agreement, Paragraph 5.).

Taxpayer will sub-meter Equipment to allow Taxpayer to perform the EV charging and all other usage billing calculations in accordance with the applicable monthly rates. A separate meter is necessary as Taxpayer must track both the timing and kilowatts of electricity usage (See Residential Rider, Metering).

Company will provide maintenance to Equipment. Customer is not allowed to move, modify, remove, adjust, alter, or change Equipment in any material way, except in the event of an emergency. All replacements of, and alterations or additions to, Equipment become part of Equipment. Customer must grant Taxpayer access rights to Customer’s property sufficient to allow Taxpayer to perform any services to Equipment (See Residential Agreement, Paragraph 4.).

Customer agrees to maintain a homeowner’s property insurance policy with minimum limits equal to the value of Customer’s property and a homeowner’s liability insurance policy with minimum limits of Three Hundred Thousand ($300,000) Dollars (See Residential Agreement, Paragraph 12.).

Customer is not allowed to assign Residential Agreement without consent of Taxpayer. A sale of Customer’s property will be treated as an early termination by Taxpayer, unless Taxpayer agrees in writing to an assignment of Residential Agreement to the purchaser of the property (See Residential Agreement, Paragraph 13.).

Customer acknowledges and agrees that (i) Equipment is personal property, will be removable, and will not be a fixture or otherwise part of the residential property; (ii) Taxpayer will own Equipment; and (iii) Customer has no ownership interest in Equipment. Title to Equipment only transfers to Customer at the end of the original term or upon any earlier termination if Taxpayer elects to not remove the equipment. Customer is required to provide timely notice of Taxpayer’s title and ownership of Equipment to all persons that may come to have an interest in or lien upon Customer’s property (See Residential Agreement, Paragraph 6.).

If Customer terminates the Residential Agreement prior to the fifth anniversary, Customer must pay a termination fee in an amount equal to the cost to uninstall, remove, and redeploy Equipment plus any outstanding Monthly Service Payments. If Customer terminates the Residential Agreement on or after the fifth anniversary, Customer must pay either a termination fee or the remaining net book value of Equipment to purchase Equipment plus any outstanding Monthly Service Payments. Taxpayer may terminate Residential Agreement for its convenience or as a result of any federal, state, or local authority directing Taxpayer to do so. Upon such termination, Taxpayer may elect to remove Equipment or leave Equipment and transfer title to Customer at no charge (See Residential Agreement, Paragraph 7.).

Commercial Program

Taxpayer provided the following documents pertaining to Commercial Program as Attachments A and B, respectively: Commercial Electric Vehicle Charging Services Rider Pilot (“Commercial Rider”) and Commercial Electric Vehicle Charging Services Agreement (“Commercial Agreement”). Commercial Rider expires four years from the effective date of Commercial Program, unless extended by approval of the FPSC. Commercial Agreement becomes effective at such time as the Commercial Rider expires and will continue for ten (10) years.

Commercial Rider and Commercial Agreement both stipulate that charging equipment (“Equipment”) will be maintained and owned by Taxpayer and that Taxpayer will design, procure, install, own, operate, and provide maintenance to EV Equipment.

Taxpayer reserves the right to remotely control charging session schedules and/or curtail the energy delivered by Equipment. Taxpayer and its customers agree that Equipment is owned by Taxpayer and there is no license, rental, or lease of Equipment (See Commercial Agreement, Paragraph 3.).

Customer pays a Monthly Service Payment, which is based solely on the cost of the installed EV Equipment and replacement costs of such Equipment. The Monthly Service Payment will be comprised of a “Monthly Equipment Cost” and “Monthly Expenses.” The Monthly Equipment Cost includes the as-installed cost of Equipment. The Monthly Equipment Cost will be levelized over the term of service based upon the installed cost of Equipment times a carrying cost. The carrying cost is the cost of capital, reflecting Taxpayer’s current capital structure and most recent FPSC-approved return on common equity. Monthly Equipment Cost also includes any replacement cost(s) expected to be incurred during the term of service. Monthly Expenses will be billed on a levelized basis over the term of service (See Commercial Rider, Monthly Service Payment).

Customer will separately pay for its electricity used based on Customer’s separate commercial rate tariff.

A separate meter is not required for Equipment under Commercial Program, as the electricity charges will be based on the customer’s underlying commercial rate tariff.

Taxpayer will provide maintenance to Equipment. Customer is not allowed to move, modify, remove, adjust, alter, or change Equipment in any material way, except in the event of an emergency. All replacements of, and alterations or additions to, Equipment become part of Equipment. (See Residential Agreement, Paragraph 4.).

Customer must maintain insurance, at its sole cost and expense. Customer must name Taxpayer as an additional insured and provide a waiver of subrogation in favor of Taxpayer (See Commercial Agreement, Paragraph 17.).

Customer must grant Taxpayer access to its property to allow Taxpayer to install Equipment, inspect and maintain Equipment, and remove Equipment (See Commercial Agreement, Paragraph 7.).

Commercial Agreement cannot be subcontracted, assigned, transferred, delegated, or otherwise disposed of by Customer without Taxpayer’s prior written approval. In the event of the sale of the real property upon which Equipment is installed, such sale shall be considered an early termination of Commercial Agreement by Customer, unless Taxpayer agrees in writing to an assignment of Commercial Agreement to the purchaser of the real property (See Commercial Agreement, Paragraph 19.).

Customer agrees that Equipment is and will remain the sole property of Taxpayer, unless and until the end of the original term (or upon any earlier termination if Taxpayer elects to not remove Equipment). Taxpayer reserves the right to modify or upgrade Equipment for the continued supply of Service but will not degrade the capability. Taxpayer and Customer agree that Equipment is personal property, will not be a fixture or otherwise part of the Customer’s property, and Taxpayer will own Equipment (See Commercial Agreement, Paragraph 11.).

If Customer terminates the Commercial Agreement early, Customer is subject to pay Taxpayer a Termination Fee. Taxpayer has the right to access and remove any and all Equipment. Title to Equipment that Taxpayer elects not to remove will transfer to Customer upon written notice by Taxpayer to Customer. Taxpayer has the right to terminate Commercial Agreement for its convenience or due to actions of any federal, state, or local authority. Upon termination for convenience by Taxpayer, Customer must choose to either (i) purchase Equipment or (ii) request that Taxpayer remove Equipment. Title to Equipment that Taxpayer elects not to remove shall transfer to Customer. Upon termination for cause, the same transfer of title choice applies. At the Expiration of Commercial Agreement, title to Equipment will transfer to Customer at no additional charge. Thereafter, Customer will be responsible for payment of all electric usage and will be responsible for all maintenance and other costs related to ownership of Equipment (See Commercial Agreement, Paragraph 12.).

Charging stations are now a familiar sight at gas stations, hotels and other locations. Information supplied by Taxpayer reflects that the Equipment that will be used in the Commercial Program is similar. Typical Equipment sits atop a concrete foundation that is 30 inches deep/thick. The charging equipment (or “dispenser”) is bolted and anchored to the concrete foundation. The controls and charging cord on the dispenser are at a height of 41.5 inches in compliance with the ADA. Electrical power will be delivered to the Equipment from Taxpayer’s transformer via underground wiring. Galvanized pipes delivering the electrical power - to the dispenser from the transformer - are cemented into the ground.

REQUESTED ADVISEMENTS

Taxpayer is asking the following questions:

1. Whether the Monthly Program Charge paid by a Customer participating in Taxpayer’s Residential Program is the payment for an improvement to real property and therefore not subject to either Sales and Use Tax or Gross Receipts Tax.

2. Whether the Monthly Off-Peak Energy Charge paid by a Customer participating in Taxpayer’s Residential Program is exempt from Sales and Use Tax and is subject to Gross Receipts Tax.

3. Whether the Monthly Service Payment paid by a Customer participating in Taxpayer’s Commercial Program is the payment for an improvement to real property and therefore is not subject to either Sales and Use Tax or Gross Receipts Tax.

4. Whether Taxpayer’s separate sales of electricity to Customers participating in Taxpayer’s Commercial Program are subject to Sales and Use Tax and subject to Gross Receipts Tax.

APPLICABLE LAW AND DISCUSSION

The primary issue identified by Taxpayer’s request is whether Taxpayer is improving real property or selling tangible personal property to Taxpayer's customers.

Section 212.05(l)(a)l .a., F.S., applies to sales of tangible personal property. It provides, in part, the following:

It is hereby declared to be the legislative intent that every person is exercising a taxable privilege who engages in the business of selling tangible personal property at retail in this state ....

(1) For the exercise of such privilege, a tax is levied on each taxable transaction or incident, which tax is due and payable as follows:

(a)l.a. At the rate of 6 percent of the sales price of each item or article of tangible personal property when sold at retail in this state, computed on each taxable sale for the purpose of remitting the amount of tax due the state, and including each and every retail sale.

Section 212.05, F.S., provides that the sale of tangible personal property is subject to sales tax on the sales price of the tangible personal property sold. The sales price can include the charge for installation and other services that are part of the sale of the tangible personal property. See s. 212.02(16), F.S., and Rule 12A-1.016, F.A.C.

As to the issue whether Taxpayer’s sales are for real property improvements, Section 212.06(14), F.S., and Rule 12A-1.051, F.A.C., apply.

Section 212.06(14), F.S., provides, in part, the following:

(14) For the purpose of determining whether a person is improving real property, the term:

(a) "Real property" means the land and improvements thereto and fixtures and is synonymous with the terms "realty" and "real estate."

(b) "Fixtures" means items that are an accessory to a building, other structure, or land and that do not lose their identity as accessories when installed but that do become permanently attached to realty....

(c) "Improvements to real property" includes the activities of building, erecting, constructing, altering, improving, repairing, or maintaining real property.

Rule 12A-1.051, F.A.C, provides, in part, the following:

(1) Scope of the rule. This rule governs the taxability of the purchase, sale, or use of tangible personal property by contractors and subcontractors who purchase, acquire, or manufacture materials and supplies for use in the performance of real property contracts. . . .

(2) Definitions. For purposes of this rule, the following terms have the following meanings:

***

(c)1. "Fixture" means an item that is an accessory to a building, other structure, or to land, that retains its separate identity upon installation, but that is permanently attached to the realty.

****

(h)l. "Real property contract" means an agreement, oral or written, whether on a lump sum, time and materials, cost plus, guaranteed price, or any other basis, to: a. Erect, construct, alter, repair, or maintain any building, ... or other real property improvement;

****

c. Furnish and install tangible personal property that becomes a part of or is directly wired ... into the … electrical system … or other structural system that requires installation of wires … or similar components that are embedded in or securely affixed to land or a structure thereon.

****

Rule 12A-1.051(2)(c)3., F.A.C, provides that the determination whether an item is a fixture depends upon a review of all the facts and circumstances. Items that are joined directly to a structure’s wiring systems are likely to be classified as fixtures. Attachment in such a manner that removal is impossible without causing substantial damage to the underlying realty, indicates that an item is a fixture. If the property holder who causes an item to be attached to realty intends that the item will remain in place for an extended or indefinite period of time, that item is more likely to be a fixture. If an interest in an item arises upon acquiring title to the land or building, the item is more likely to be considered a fixture. If installation of an item requires licensing of the contractor (e.g., licensed electrician) under statutes or guidelines governing the building trades, that item is more likely to be regarded as a fixture.

Rule 12A-1.051(3), F.A.C, provides the classification of contracts by pricing. The taxability of purchases and sales by real property contractors is determined by the pricing arrangement in the contract. Contracts generally fall into different categories. As to lump sum contracts, the contractor agrees to furnish materials and supplies, and necessary services, for a single stated lump sum price.

Rule 12A-1.051(4), F.A.C, provides that real property improvement contractors are the ultimate consumers of materials and supplies they use to perform real property contracts and must pay tax on their costs of those materials and supplies.

Taxpayer has asserted in writing that all of the EV charging equipment for both Residential and Commercial customers is hardwired into real property by a licensed electrician. Furthermore, the documentation provided by Taxpayer indicates that the EV charging equipment is intended to remain in place for an extended or indefinite period of time. Based on this information, Taxpayer’s sales are for real property improvements. Taxpayer would be liable for the tax on its purchases of tangible personal property associated with the real property improvements. The discretionary sales surtax is due based on where the tangible personal property is delivered. See Rule 12A-15.008(l)(a), F.A.C.

Sales Tax on Sales of Electricity:

Section 212.05, F.S., provides that the sale of tangible personal property is subject to tax. All sales of tangible personal property in the State of Florida are subject to tax, unless specifically exempt by Chapter 212, F.S. Section 212.02(19), F.S., defines tangible personal property as "personal property which may be seen, weighed, measured, or touched, or is in any manner perceptible to the senses, including electric power or energy." Section 212.05(1)(e)1.c., F.S., provides that the tax rate for sales of electrical power or energy is 4.35 percent.

Section 212.08(7)(j), F.S., provides a specific exemption for sales of utilities to residential households or residential models in Florida by utility companies who pay the Gross Receipts Tax required under s. 203.01, F.S.

Rule 12A-1.053(1)(a), F.A.C., indicates that “[t]he sale of electric power or energy by an electric utility is taxable. The sale of electric power or energy for use in residential households, to owners of residential models, or to licensed family day care homes by utilities who are required to pay the gross receipts tax imposed by subparagraph 203.01(1)(a)1., F.S., is exempt. Also exempt is electric power or energy sold by such utilities and used in the common areas of apartment houses, cooperatives, and condominiums, in residential facilities . . . .”

Rule 12A-1.053(1)(b)1., F.A.C., provides that “[a]n electric utility is not obligated to collect and remit tax on any sale of electric power or energy when the electric power or energy is sold at a rate based on the utility’s ‘residential schedule,’ under tariffs filed by the utility with the Public Service Commission . . . .”

Section 366.02(2), F.S., defines “electric utility” as “. . . any municipal electric utility, investor owned electric utility, or rural electric cooperative which owns, maintains, or operates an electric generation, transmission, or distribution system within the state.”

Gross Receipts Tax:

Section 203.01, F.S., imposes a tax on gross receipts from utility services that are delivered to a retail consumer in this state. Section 203.012(3), F.S., defines “utility services” as “. . . electricity for light, heat, or power . . . including transportation, delivery, transmission, and distribution of the electricity . . ..” The tax rate applicable to electrical power or energy is 2.6 percent.

CONCLUSIONS

Based upon a review of the terms and conditions of both the Residential Program and the Commercial Program and the assertions made by Taxpayer, the following answers are given to the questions asked:

1. Whether the Monthly Program Charge paid by a Customer participating in Taxpayer’s Residential Program is the payment for an improvement to real property and therefore not subject to either Sales and Use Tax or Gross Receipts Tax.

Because under both the “Equipment Only Installation” and the “Full Installation” the equipment is hardwired into 240 volt circuits by electricians, Taxpayer is making improvements to real property; therefore, Taxpayer would not charge its Residential customers sales tax or gross receipts tax on the Monthly Program Charges.

2. Whether the Monthly Off-Peak Energy Charge paid by a Customer participating in Taxpayer’s Residential Program is exempt from Sales and Use Tax and is subject to Gross Receipts Tax.

Correct. The Monthly Off-Peak Energy Charges paid by residential customers are exempt from Sales and Use Tax and are subject to Gross Receipts Tax.

3. Whether Monthly Service Payments paid by Customers participating in Taxpayer’s Commercial Program are payments for the improvements to real property and therefore are not subject to either Sales and Use Tax or Gross Receipts Tax.

Based on the facts provided, Taxpayer is making improvements to real property; therefore, Taxpayer would not charge its Commercial customers sales tax or gross receipts tax on the Monthly Service Payments.

4. Whether Taxpayer’s separate sales of electricity to Customers participating in the Commercial Program are subject to Sales and Use Tax and subject to Gross Receipts Tax.

Correct. Taxpayer’s sales of electricity to its Commercial customers are subject to Sales and Use Tax and are also subject to Gross Receipts Tax.

This response constitutes a Technical Assistance Advisement under s. 213.22, F.S., which is binding on the Department only under the facts and circumstances described in the request for this advice, as specified in s. 213.22, F.S. Our response is predicated on those facts and the specific situation interpretations of the statutes or rules upon which this advice is based may subject similar future transactions to a different treatment than expressed in this response.

You are further advised that this response, your request and related backup documents are public records under Chapter 119, F.S., and are subject to disclosure to the public under the conditions of Section 213.22, F.S. Confidential information must be deleted before public disclosure. In an effort to protect confidentiality, we request you provide the undersigned with an edited copy of your request for Technical Assistance Advisement, the backup material and this response, deleting names, addresses and any other details which might lead to identification of the Taxpayer. Your response should be received by the Department within 15 days of the date of this letter.

Leigh L. Ceci

Tax Law Specialist

Technical Assistance and Dispute Resolution

(1)