AMAZON STARTS CHARGING SALES TAX IN FLORIDA – MAY 1 2014

The sunshine state is a little less sunny now because all our online shopping through Amazon is now subject to sales tax as of May 1, 2014. The glory days of tax free shopping, at least on Amazon, is over. Everyone please take a moment to bow your head in a moment of remembrance. From this point forward, unless you can provide a valid resale certificate (or have a good friend living right across the state line in Georgia or Alabama), you will be paying sales tax when you check out. The tax rate will be the 6% state sales tax rate plus whatever the local sales surtax rate is where you live, which can run between 0% and 1.5%. Add the state and local rate together to get your "sales tax" rate imposed on your purchase.

The trade off - Amazon is building not one, but two fullfillment centers in Florida, creating more than 3,000 jobs. The locations will be just outside of Lakeland (East of Tampa and South of Orlando) and Ruskin (South East side of Hillsborough County). This will be a boom for the local economy and allow all you shoppers out there to get your on-line shopping much faster. Actually - rumor has the ultimate plan for Amazon is to impement a same day delivery system. Personaly, I'm looking forward to the Amazon Drone to land in my back yard.

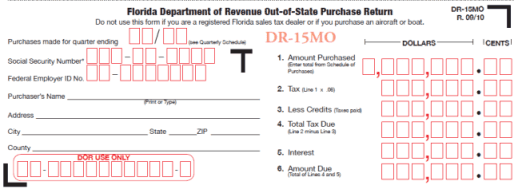

Actually – it might surprise a few of you to learn that all those Amazon purchases you have been making in Florida before May 1st were not tax free. That's right – while Florida could not force Amazon to collect sales tax from you on that purchase, Florida law does require you, the purchaser, to pay "use tax" on all of your taxable purchases that you did not pay sales tax on. The use tax is a compliment to the sales tax and every state with a sales tax also has a use tax. The use tax is supposed to account for out of state purchases – just like those purchases you have been making on Amazon. You can report and pay your use tax on a Form DR-15MO (shown below), which can be found on the Florida Department of Revenue's web site. If you file the return, you will be among about 200 other politicians and high ranking Florida Department of Revenue officials that actual do file and pay their Florida use taxes.

The reason why you have not heard about the use tax is because Florida, and all the other states with a sales tax, have not had a cost effective way of finding out what you have been purchasing. Seriously – could you imagine the Florida Department of Revenue sending out auditors to do fishing expedition use tax audits on residents of Florida – looking at bank statements, credit card records, etc. It would be political suicide for the Revenue official who signed off on those kind of audits. So the state has been left with very, very little use tax collections other than from businesses, which do go through sales and use tax audits regularly.

However, the states have not been sitting by idly to let use tax go uncollected forever. There has been a very big push for the Federal Government to get involved. Combining a desire to simplify sales and use tax laws in this county with collecting sales and use tax from remote purchases, such as purchases by Florida residents prior to May 1st, groups have been lobbying Congress to pass the Marketplace Fairness Act. Under this bill, which passed in the Senate but not the House in 2013, every remote seller with more than $1 million in remote sales will be required to collect sales tax on all remote sales. That would require the seller to understand and properly calculate the sales tax for 45 states and almost 10,000 local sales tax jurisdictions – not to mention file sales tax returns. These remote sellers would also have to go through sales and use tax audits from 45 states, which would amount to 8 audits a year if the states audit them every 5 years. Sure – Amazon could handle this, but it would be an administrative nightmare for a small remote seller, putting thousands of small businesses out of business. If this sounds like a bad idea to you, then you should read some of the links below to learn more and how you might be able to get involved.

ABOUT THE AUTHOR: Mr. Sutton is a Florida licensed CPA and Attorney and a shareholder in the law firm the Law Offices of Moffa, Sutton, & Donnini, P.A. Mr. Sutton is in charge of the Tampa office of the firm and his primary practice area is Florida sales and use tax controversy. Mr. Sutton worked in the State and Local Tax department of a "big five" accounting firm for a number of years and has been an adjunct professor at both Stetson University College of Law since 2002 teaching State and Local Taxation and Boston University teaching Sales and Use Tax at the LLM level. You can read more about Mr. Sutton in his firm BIO.

ADDITIONAL RESOURCES

MARKETPLACE FAIRNESS ACT: THE FALLACY OF SIMPLIFICATION AND THE PRIVATE REPORTING SOLUTION, State Tax Notes, April 24, 2014, by James H Sutton, Jr., CPA, Esq.

IS THE MARKETPLACE FAIRNESS ACT NEEDED TO SOLVE THE PROBLEM OF REMOTE SALES, Forbes, April 24, 2014, by Cara Griffith

AAA-CPA OPPOSES MARKETPLACE FAIRNESS ACT, published May 2, 2013, by James Sutton, CPA, Esq.

US SALES AND USE TAX SYSTEMS NEEDS FEDERAL C.P.R., published March 6, 2014, by James Sutton, CPA, Esq.